Do you want to buy a car? How many years loan are you going to take? Have you heard people say “I want to take 9 years loan but I will make early settlement to save on the interest”? You have, right? But does it really work that way?

Or should you just get a car for 5 years loan? How does bank charge the interest? Wait, how many types of interest are there for car loans?

Lets start!

So there’s two(2) types of interest commonly used in Malaysia for car loans (Hire purchase).

FIXED RATE INTEREST

Fixed rate interest is calculated on the borrowed amount, which won’t change, thus interest charges can be quite high.

1) Most common loan

2) Fixed monthly installment

3) How to calculate?

i) Loan amount: RM 100,000

ii) Interest rate: 2.8% for 9 years

iii) How to calculate interest:

= RM100,000 x 2.8% = RM 2,800 (1 Year interest)

= RM 2,800 x 9 (nine years loan),( If 5 years loan, then you x 5 OR 3 years then you x 3)

= RM 25,200 (Total interest for 9 years)

iv) Then you take your initial loan amount:

= RM 100,000 + RM25,200

= RM 125,200 ( Total amount to pay back to the bank)

v) How to count monthly payment:

= One year(1) = 12 months

= Five years(5) = 60 months

= Nine(9) years = 108 months

So, If your loan is 9 years, this is how you calculate it:

= RM125,200 /108 months

= RM 1159.26 (Your monthly installment every month for 9 years)

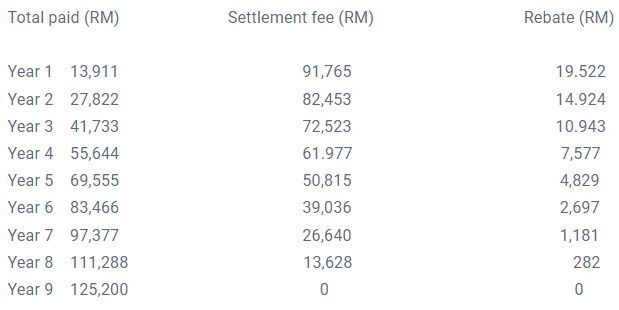

Look at this table below.

If you look at the table, you can see that the total interest charges for a RM 100,000 loan on a 2.8% interest rate is RM 25,200, but the borrower who makes an early settlement on the fifth year gets less than RM 5,000 in rebates on interest charges, or one-fifth of the total interest, even though he is paying off his loan nearly 50% faster.

This is because there is something called Rule of 78. It ensures the banks earn its profit well before the borrower make early settlement. So basically, the first three years or so of your loan, the monthly installments that you pay will go mostly to your pay of the interest charges and very less to your loan amount.

See? Do you see how the the banks work? Simply put, Rule of 78 ensures that the banks get paid first, and your debt is paid last.

Fyi, Rule of 78 is actually banned in several countries due to its nature of being such a rip off. Countries like UK, Australia, New Zealand and even the USA. There, the banks are only allowed to use Rule of 78 for loans no longer than 5 years (still the banks will be able to accumulate most of their profits by that time). The Consumer Credit Oversight Board Task Force (CCOB) in Malaysia has actually proposed for Rule of 78 to be abolished but Bank Negara has yet to make any decision on the matter.

So, if you plan to save on interest charges by making an early settlement on a 9-year loan, you need to do it within the third(3) year. The potential rebates diminishes rapidly once you enter the fourth year.

The banks will make sure that they take the interest money first so that when people come to do early settlement, it will not affect their interest(profit). So, from the fourth(4) year onwards, the monthly installments that you pay will go more to reducing the initial loan amount that you took. So, only after the banks have made most of its profits in the first 3 years, will you then start paying off your initial loan amount for the remainder of your loan period.

So, you’re not actually saving money when you make an early settlement on your fixed rate car loan, even though there are rebates because the banks will have already taken their profits within the first few years.

People might say that it’s better to take a longer 9-year loan with lower monthly instalments, and then make an early settlement to save on interests but these people can suck it. Haha, just kidding. That is partially true because as you can see on the table above, there will be some rebates if you make early settlements, but know that banks have thought everything through so you can’t really outsmart the bank- can la, but very very difficult.

The bank always had the upper hand and one of their most successful marketing efforts is to make borrowers think that they can save some money by taking a longer 9-year loan but make an early settlement. Which is definitely not the case.

Phew….This reminds me of my maths teacher Mr Teh Tatt Leong. A great guy. So enthusiatic about Maths and Add maths. Too bad, we couldn’t care less. Thanks Mr Teh! And sorry for not focusing more in class.

Alright, enough flashback.

Now, lets just say that you have cash ready for early settlement or you plan for an early settlement. Then, maybe you should consider this next one.

VARIABLE RATE INTEREST

Variable rate products are less common in malaysia. Variable rate products simply means means that your monthly repayment is not fixed. It changes every month. Thought it depends on the base lending rate (BLR) stipulated by the bank. If the BLR changes, then your monthly installment changes. As long as it remains, your monthly payment will still reduce little by lttle because the monthly repayment is calculated on the remaining balance of your loan amount, every month.

The interest charges are calculated using the reducing balance method, on the loan’s remaining balance- similar to home loans(Mortgage). Thus, total interest charges will keep going down and down because the interest charges are calculated every month, based on the remaining balances of the loan. And you are continuously servicing the loan right? So the loan’s remaining balance keeps going down. So that’s why every month the interest charges will only keep getting lower and lower as you continuously make payments. Read that again if you’re confused. Read it aloud.

This Variable rate interests has its risks too. Imagine if market conditions are bad and the BLR increases, you could see your installment amount increase. On the other hand, if the rate goes down, the amount paid monthly also goes down.

One of the benefit of Variable rate interest is, if you have some extra cash available, you can also pay more than the given monthly installment amount. The faster you clear the balance, the less you pay in the following months. Some banks provide you with the opportunity to reduce your interest by making extra payments toward the principal amount, which can also reduce the installment amount for the following months.

So, when you see that the interest and installment amounts go down, the best thing for you to do is to make extra payments and you just might run down your loan sooner rather than later.

Hence, with variable rate car loans, sometimes you may pay more than traditional fixed rate loans, other times you may pay less- depending on the changes in BLR. So, always be up to date with the latest BLR.

So, do you see the difference now?

Keep in mind, you cannot compare interest rates of fixed rate products with variable rate ones, because the methods of calculation are different.

Despite the above, one still cannot say that variable rate products are better than fixed rate products. Like all financial products, what is good or bad is highly dependent on your individual needs, income, commitments, and financial goals.

Conclusion – know where you stand, understand your car needs, be smart with your finances

This article is in no way saying that variable rate products are better than fixed rate products, because either way we are still getting the short end of the stick and the banks walk away laughing- with our money. We are stuck in this oppressive system and there’s nothing much we can do to escape it except if we get rich. Though, not everyone is as lucky. Most of us will be in the B40 category till the angel of death comes knocking on our doors. (Sorry, things took a dark turn there)

So, just make sure you live below your means, so you have cash for rainy days (try full settlement early if you can). Invest in things. Dont just keep the money. Be a good paymaster and service your loans responsibly and keep working hard. Eventually, things will turn out just fine.

The first step in making the right decision is to ask yourself what your financial goals are, and what do you need from a car. Only then can you decide which is the best financing option, and which is the best car for you.