Financing a pre-owned car can be a smart move for car buyers who want to save money while still driving a high-quality vehicle. However, financing options for pre-owned cars can vary slightly compared to buying a new vehicle.

While getting a second hand car is a good financial decision, it also often comes with higher interest costs compared to financing a new car. This is because lenders generally see pre-owned cars as more risky investments due to their faster depreciation rate.

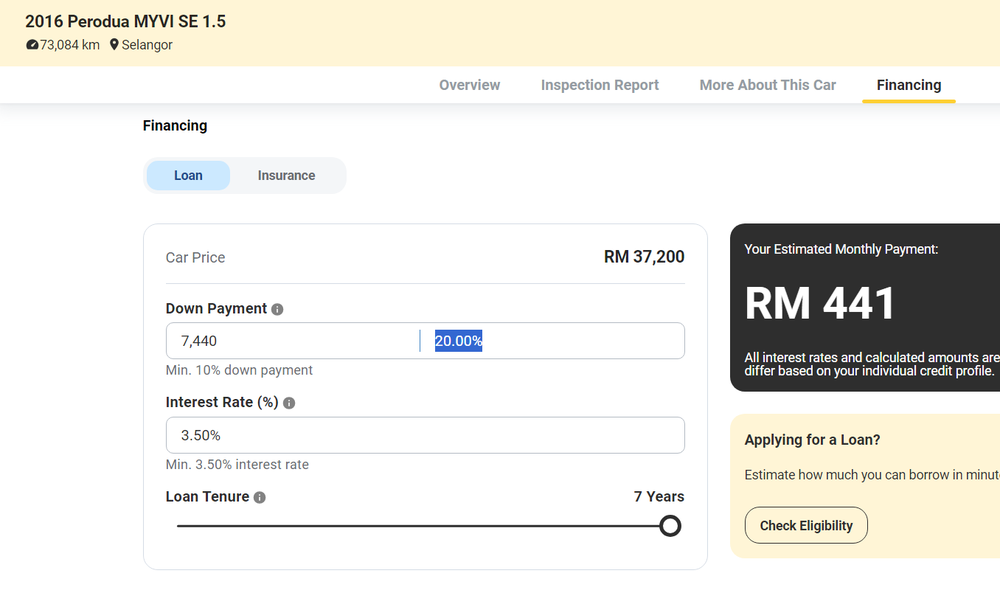

Ideally, a large down payment, 20% or more, will help reduce your monthly installments, as you will need to borrow less. The monthly installment is usually calculated based on the outstanding principal loan amount, so the more you pay upfront, the lower your monthly payments will be.

On top of that, if your monthly car payments consume more than 30% of your monthly income, it will significantly impact your budget and limit your financial flexibility.

To budget wisely for your car’s monthly installments, consider the 20/7/20 rule of thumb based on your salary. Aim to pay a 20% down payment instead of the usual 10%, which will significantly lower your monthly payments. Stick to a 7-year loan tenure, as more extended loan periods can result in higher interest charges. Lastly, limit your monthly car payments to 20% of your total income to ensure financial stability and a healthy credit score.

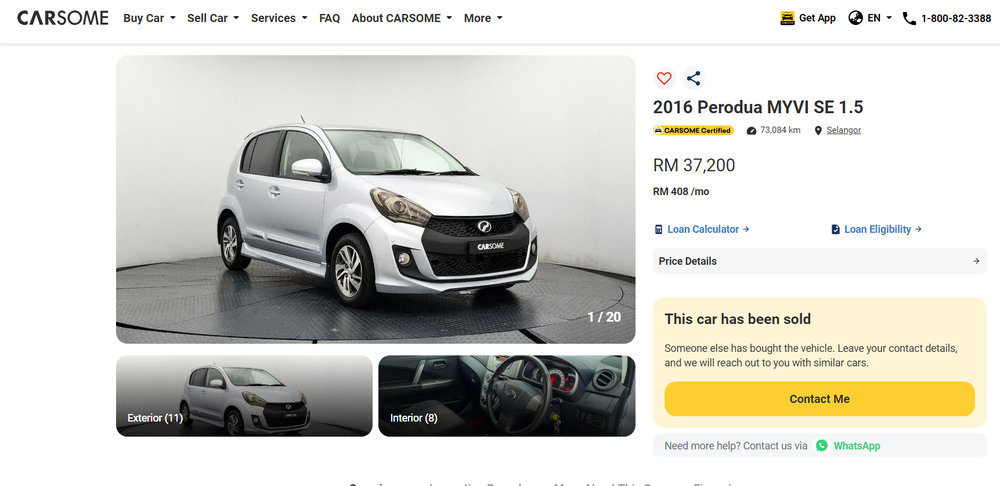

To clarify, let’s say you have your eye on a used 2016 Perodua Myvi SE 1.5 priced at RM37,200. If you cough up a deposit of RM 7,440, which covers 20% of the total price with a seven-year loan, the monthly payment will only be RM 441.

If you have a monthly salary of RM3000, setting aside 20% would amount to RM600 for car payment. This should be sufficient enough to cover the Myvi monthly payment and other expenses like maintenance, insurance, and road tax.

If you have other options but are uncertain about the monthly payments, you can always head up to the CARSOME loan calculator. It will accurately calculate your estimated monthly payments based on your specific loan terms, whether you’re planning to purchase a new or used car. This tool can assist you in budgeting and financial planning for your car purchase.

Purchasing a quality certified pre-owned car is also crucial in avoiding unexpected maintenance costs down the road. By opting for a car that has undergone meticulous inspection, safety testing and professional refurbishment, such as a CARSOME certified car, buyers can rest assured that the vehicle has met and exceeded safety standards and will require minimal maintenance. This can save both time and money in the long run, allowing buyers to focus on enjoying their new car without worrying about costly repairs.

In Malaysia, interest rates for car hire purchase loans vary based on several factors, including the brand and model of the vehicle, whether the car is new or used, the borrower’s creditworthiness, the total loan amount, the loan tenure, and other factors specific to the individual borrower. These factors can significantly influence the interest rates offered by different lenders.

However, with CARSOME partnering with CIMB Bank, students who want to purchase a preowned car now enjoy low interest rates of 2.89%.

As an added bonus, CARSOME’s Year-End Gempak Promotion is currently in full swing, where lucky winners can stand a chance to win free car installments worth up to RM84,000, giving you even more value for your car purchase